Policy Recommendations

- In renewed contract negotiations, the EU should refrain from unnegotiable conditionalities, and work on reversing the perception of Africa being a ‘humanitarian burden’ rather than a continent full of opportunities.

- There should be a clearer focus on facilitating sustainable Foreign Direct Investment.

- Concerning trade regulation, it is important to concentrate more on truly diversifying trade, and improving current Rules of Origin.

Abstract

The Cotonou-Agreement between the EU and ACP-countries expires in February 2020. Until now, Africa in particular has not benefitted significantly from globalization and international trade, yet with its growing young population and untapped economic potential, it seems likely that the continent will occupy a major position in the future global economy. Recently a new, dominant player has been influencing this field. China has been proclaimed both a neocolonialist threat and Africa’s savior by international observers — yet, while concerns about human rights, imported labor force, and asymmetric trade remain, several governments, renowned economists and a large part of the African population seem to believe that certain aspects of the Chinese approach are indeed more helpful for economic development than former European endeavors. In light of the upcoming Cotonou negotiations, this paper aims to ascertain what exactly makes Chinese activities in Africa arguably more successful and more popular. The results make it clear that current plans to go forward with similar propositions as in the old Cotonou agreement will be met with frustration and disagreement. Change is needed and instead of looking West, maybe this time solutions can rather be found in the East.

****************************

Cotonou 2020 –

What the European Union can learn from Chinese trade and investment relations with Africa

Introduction

In the past decades the world has gone through vast geopolitical changes. Globalization, stagnating growth in the west and the financial crisis have highly influenced our thinking regarding trade, finances and politics. One country that especially caught the interest of academia and policymakers was China, astonishing the international community with their economic success and unconventional strategies – both in internal and foreign affairs.

Concerning Africa China fosters its relations with a completely different approach politically and economically than what the continent has experienced so far. While criticized in the West, many African stakeholders perceive this engagement as largely positive, and steadily growing in importance. If Europe wants to stay relevant, it therefore needs to start revising its own neighborhood policies. This necessity is particularly pertinent for the renegotiations of the “Cotonou Agreement”, which is going to expire in February 2020. Signed in 2000, this comprehensive cooperation covenant between the EU and ACP-countries (African, Caribbean and Pacific) introduced a new trade regulation framework, altered aid allocation rules, and put a stronger focus on the political dimension of ACP-EU development cooperation – the success of which being much debated (European Commission 2017) (Koné 2010, 106). Britain’s withdrawal from the EU adds another layer of considerations in future negotiations, as the UK is the most important consumer for products from ACP-countries. In 2015, it accounted for 35.5% of all imports into the EU from the East African Community. Losing the UK therefore also means losing leverage and importance in the context of trade agreements with Africa (GRAIN 2017).

Why after so many decades of FDI in Africa by the West, Africa still remains one of the poorest and least industrialized parts of the globe? How can Europe reposition itself in the wake of new and renewed investment players in the African investment stratosphere? (Bodomo 2017, 19)

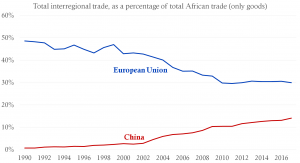

Total interregional trade, as a percentage of total African trade, 1990 – 2017

Source: IMF Direction of Trade Statistics (DOTS); UN Comtrade (http://comtrade.un.org/data/); (Johns Hopkins SAIS 2018)

While most European countries have stagnating or decreasing Foreign Direct Investment (FDI) outflows (EU: US$ 493.5 bn in 2011 to US$ 470.4 bn in 2016), in just 5 years China recorded an increase of 145% from US$ 74.7 billion in 2011 to US$ 183.1 billion in 2016 (UNCTAD 2017). While the southern hemisphere is looking to fill its infrastructure gap, the EU is steadily losing momentum as global investor. In developing countries, trade and investment play a significant role. Trade represents, on average, 34% of the countries’ GDP – compared to 20% in advanced economies – and rises fastest in Africa, Asia and Latin America (World Trade Organization 2017b).

This policy brief, based on a broader academic research paper, aims to answer the question of what the EU can learn from China’s international strategy towards Africa. Large scaled evidence is underscored by specific examples from Nigeria, which was deemed a representative example of a resource rich country with active relations to both China and the EU.

1. Why conditionalities are counterproductive in international relations

Besides direct economic effects triggered by trade and investment, the cultural/political environment as well as general opinions about each other always form the baseline in trade and investment negotiations. Ever since colonialism, FDI and loans granted by Western powers to Africa were considered to have the side effect of preserving a certain amount of influence in running these economies (Bodomo 2017, 24f.). It is true that so-called “conditionalities” are more often connected to trade or aid than to investment, however, leading to unstable political and economic systems, they ultimately influence investment as well. Bodomo argues that it was certain military coups and uprisings against imperialism that caused dictatorship regimes (Bodomo 2017, 27). The kind of socio-political expectations, which are imposed on countries before any transaction can occur, often include demands to redesign the country’s political system to be a multi-party democracy, installing rule of law, free press, freedom of speech etc. While promoting these values is not per se condemnable, on the contrary, explicit efforts to “export” values are simply unsustainable. Although well-intentioned, these requirements are mostly perceived as “modern-day post-colonial attempts to re-engineer colonial ‘civilizing missions’ – the need felt by Europe to bring civilization to ‘primitive` and less advanced societies.” (Bodomo 2017, 25f.)

The Chinese approach to foreign policy, on the other hand, is based on the “Five Principles of Peaceful Coexistence” (mutual respect for territorial integrity and sovereignty, mutual non-aggression, mutual non-interference in each other’s internal affairs, equality and cooperation, peaceful co-existence). It strongly emphasizes their disfavor of neo-colonial forces and the Washington Consensus, which focuses on trade liberalization, privatization, deregulation, and is often called to support so-called “market fundamentalism” or “neoliberalism” (Alden und Alves 2008, 46ff.). Already in 1964, 53% of all loans given to Africa were granted by the new Asian ally, especially known for their “no strings attached” policy. Of this, the western world has mostly been critical, accusing China of supporting corrupt regimes, acting non-transparently and exploiting African resources for their benefit (Cheru und Obi 2011, 72). Nevertheless, history shows that the other extreme seems to be just as destructive as China’s attitude is said to be. Studies demonstrate that the wider South African public positively describes China as emphasizing “Realpolitik” (therefore more practical relations) versus the European ideological approach, thereby feeling less questioned in their integrity (Fioramonti und Kimunguyi 2011, 76ff.). Another empirical study (Ayoola 2013, 101), surveying Nigerian stakeholders in manufacturing found that 89% of all participants generally reckoned trade relations with China to have a positive impact on the Nigerian economy, even if all of them also see it as a challenge for domestic industries.

In fact, China is convinced that just like themselves African states are not ready for liberal multi-party democracy and that pushing for such reforms is the very reason for conflicts (Carmody 2011, 179). Empirical evidence supports this statement, when for example the 2007 election in Kenya resulted in 1.500 people being killed because of ethnic disagreements (ibid.). These kinds of tensions led to the wave of democratization being weakened since 1995 and has even found Western researchers on the side of the Chinese: Paul Collier, an Oxford development economist, calls it “democrazy” (ibid.).

It would appear that democracy must be internally driven to be sustainable (…). (Carmody 2011, 1809)

Mr. Bodomo, a Ghanaian Professor for African studies at the University of Vienna, stresses the distinct difference between conditionalities and contractual conditions. Negotiations between China and Africa, as well as any other bilateral agreements are always based on more or less symmetrical rules of engagement, however, these are in fact negotiable and do not include a full list of asymmetrical constraints without any possibility for discussion (Bodomo 2017, 27f.).

First, you build the roads and lay the powerlines, then the rest of the economy follows. – Jeffrey Sachs

Even Jeffrey Sachs, one of the world’s leading experts on development economics and poverty, calls Chinese investments in power plants and roads extremely valuable for the African continent. Although he admits that the issue of bringing Chinese workers is not beneficial, he argues that at least the infrastructure built can lead to new businesses and jobs. He appreciates their sole focus on pushing forward projects rather than promoting a certain kind of political idea, and also adds, that in his opinion, only such true investment can put an end to the refugee crisis (Etzold 2016). Paul Collier seconds him and urges Europe to stop preaching and turn “small, photogenic humanitarian projects” into “scalable initiatives that will make Africa’s economy attractive for investors”. In his opinion, the EU would do well, if they took the positive aspects of China’s actions in Africa while at the same time mitigating known negative side effects, such as lacking transparency and spill-over effects (Stefan 2017). The EU’s “External Investment Plan” (EIP) announced last year, although mainly launched to prevent mass migration, might be the first step in this direction.

1.1 The perception of Africa being a “humanitarian burden“

The current focus on aid is triggered by a long history of one-sided relations, which, together with extensive “aid marketing”, in due time led to Europeans viewing Africa mainly as humanitarian burden, instead of a continent full of opportunities. It is almost notorious to engage in activities in Africa without primarily focusing on humanitarian causes. On the surface, this is a good cultural value, yet when digging deeper it is often conceived as paternalistic in nature (Bodomo 2017, 26f.). One could even argue that concentrating on aid is partly the cause for tensions and negative sentiments towards each other. Whereas Europe feels unappreciated for “altruistically” giving part of their wealth, African governments and people either feel that the amount sacrificed is ridiculous compared to existing material wealth in Europe, or frustrated realizing that the type of aid given did anything but sustainably develop their economies. One of the reasons why China does not view Africa as “humanitarian burden” is because their focus lies much less on aid (even though they have undertaken vast humanitarian aid programs themselves) (Bodomo 2017, 37ff.). Even if the definition of the relationship as proper “South-South-Cooperation” is not completely true given China’s economic success, they still appear to see each other as relatively equal partners with similar internal issues. This does not mean the EU should start ignoring what is happening in the developing world, but maybe it can be seen as a wake-up call to shift priorities, especially in areas that are usually served by the private sector.

2. The importance of sustainable Foreign Direct Investment

There is virtually no country in the world in this age of globalization that does not encourage foreign investment one way or another. There must therefore be a globally implicit understanding that FDI is necessary to spur development. (Bodomo 2017, 11)

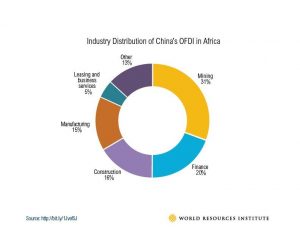

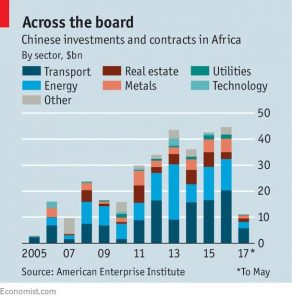

In 2016, weak commodity prices and slowing down economic growth caused FDI inflows in developing economies to fall by 14% to US$ 646 bn (back to 2010 levels). The fall in external financial flows is particularly worrisome in light of the 2030 Sustainable Development Goals (SDGs). According to UNCTAD, developing economies fall short approximately US$ 2.5 trillion in domestic and international resources (UNCTAD 2017, 12). Past experience shows that one of the most efficient manners to build necessary infrastructure is indeed capital investment by foreign investors (Bodomo 2017, 11ff.). As for this matter, it is striking how much China’s investment activities in Africa have grown in the past years. FDI flows are steadily increasing, from US$ 74.8 mn in 2003 to US$ 3.4 bn in 2013. These numbers are still quite low compared to the EU’s approx. US$ 10 bn in 2003 (EU-25) and US$ 23.4 bn in 2013, however in relative terms there is only a small difference: China’s outflows to Africa in 2013 equal to 3.1% of its total outflows, and the US$ 23.4 bn amount to 3.2% of total EU-28 FDI outflows (United Nations Conference on Trade and Development 2016) (EUROSTAT 2017). But what is most astonishing is not (yet) the absolute volume, but the speed at which Chinese investment is growing — while FDI by the EU-15 in the SSA region only demonstrates annual growth of 17.1%, Chinese FDI grows at a rate of 115% annually (Wouters, Defraigne und Burnay 2015, 379). Relative numbers describing FDI stock are largely analogous. China managed to promote FDIs by supporting poorly performing Chinese companies to start over in Africa, often subsidizing them through the “African Development Fund”, as well as by actively supporting the installation of “Special Economic Zones” (SEZs) (Cheru und Obi 2011, 73f.). The seven SEZs spread across Africa vary considerably in their sector focus and size, which is a piece of evidence for Chinese intentions not being solely about resource extraction (Bräutigam und Xiaoyang 2011, 31). In 2005, infrastructure commitments from China even outgrew those of the World Bank (Fioramonti und Kimunguyi 2011, 71).

Source: http://www.wri.org/blog/2015/01/china%E2%80%99s-overseas-investments-explained-10-graphics#fnref:7

Industry Distribution of China’s OFDI in Africa

Source: https://www.economist.com/news/middle-east-and-africa/21725288-bi

2.1 Special Economic Zones as method for increasing growth and diversifying production

It seemingly being one of the major factors for the Chinese success, it is assumed that SEZs will boost diversification of the economy and promote manufacturing in Africa (Kim 2015). Their role in the economic system is certainly significant, accounting for approx. 20% of exports in emerging and developing countries. (Farole 2011, 44). The two in Nigeria, Lekki Free Trade Zone (LFTZ) and Ogun State Free Trade Zone (OGFTZ), are in fact Joint Ventures, which increases the chance for better knowledge transfer and a smoother transition after the usual 50 to 99-year long concessions (Bräutigam und Xiaoyang 2011, 47). The Chinese consortiums own 60-82%, local governments approximately 20%, and Lekki Worldwide Investments Ltd. owns 20% of the LFTZ. This kind of share grants Nigerian stakeholders the role of the deputy president of the board as well as positions as senior managers for legal affairs and local promotion. Their industry focus reaches from transportation equipment, textile & light industries, and telecommunication to construction materials, ironware, medicine, and computers (list not exhaustive) (Bräutigam und Xiaoyang 2011, 31ff.). For what it’s worth, China continued their non-interference policy by taking a “hands off attitude” toward the host government’s policy decisions on these zones, and accepted zones failing due to mishandled policymaking. They did, however, offer capacity building: by inviting African officials to a 20-day-long workshop during which field trips and experience sharing were meant to give an understanding, what was most crucial to success stories such as the SEZs in Shenzhen and Tianjin. The participants were introduced to China’s practices without having been imposed with specific conditionalities. While this kind of compartment can still be interpreted as indirect effort to control host governments’ actions, it seems as if the perception as being independent in one’s decision is what counts. The lead in negotiations was not taken by the Chinese government, but instead given to the companies themselves that wanted to manage the project overseas, which suggests minimal political influence (Bräutigam und Xiaoyang 2011, 35, 48). Studies by the World Bank and Multilateral Investment Guarantee Agency (MIGA) established that the two zones are making significant progress, that the LFTZ employed 80% Nigerians by 2012 and that investigated projects were deemed to have met worker accommodation standards on site (EBRD), certain labor standards (e.g. no employees under the age of 18), and best practice health and safety standards (World Bank 2012, 3, 6f.) (Multilateral Investment Guarantee Agency (MIGA) 2017, 5f.). In fact, it was reported that official agreements between the two sides require at least 40% of the workforce to be Nigerian (Bräutigam und Xiaoyang 2011, 44). While the Chinese led zones allow foreign companies and investors, for example to increase competitiveness and value chain efficiency (Bräutigam und Xiaoyang 2011, 43), it was not possible to find any kind of involvement by the European Union or EU-companies in these projects.

Therefore, instead of downplaying Chinese engagements as destructive, the European Union could set an example by increasing their investment, focusing on its sustainability (i.e. securing local employment and knowledge-transfer) and supporting European firms to participate, via SEZs or possibly Joint-Ventures.

3. Trade regulation, diversification, and rules of origin (ROOs)

3.1 Trade policy and Free Trade agreements

First evaluations of the Economic Partnership Agreements (EPAs) do not show expected results and many countries are reluctant to sign an EPA. In these contracts, under the umbrella of the Cotonou agreement, the EU provides immediate tariff-free and quota-free access for 100% of its imports, whereas the partner country is typically required to offer free access for at least 80% of their imports from the EU, within a certain transition period (Andriamananjara, et al. 2009, 2). Until December 2016, only one regional EPA (Southern African Group) and seven bilateral agreements had been ratified (Giesbert, Pfeiffer und Schotte 2016). They are often perceived as a “reflection of the predominance of European economic interests” and a “fear of a contraction of their public policy space”. Countries are especially concerned about their agricultural as well as manufacturing sectors – under free trade rules, the EU is able to lucratively export processed food products, while African farmers are bound to produce products with a much lower margin, such as raw coffee and cotton for EU markets. This is especially problematic for small-scale farmers, which account for 90% of all farms but do not have the capacity to stay competitive in such an environment. Furthermore, it has to be considered that many EU agricultural products are often subsidized and might therefore ultimately displace inter-African exports (GRAIN 2017) (Sanders 2015, 566). The intention to increase African domestic integrated markets in order to stimulate FDI (Wouters, Defraigne und Burnay 2015, 42) did not necessarily prove to be successful once individual countries started signing interim EPAs before regional negotiations came to a conclusion, but instead required new border controls within economic free trade regions in order to enforce EPA commitments (Sanders 2015, 568). The result of such deals with Ghana and Côte D’Ivoire was the existence of four different trade regimes in West Africa at the same time (Sanders 2015, 567).

There is no theoretical or empirical proof that openness and all its concomitant phenomena will generate higher economic growth per se (Djeri-wake 2009, 10). Ayoola (2013, 99) writes that “Trade liberalization has cost Sub-Sahara African 272 billion dollars over 20 years.” Based on evidence from the United Nations, African countries that liberalized their trade most often even suffered from rising poverty. China itself has been quite resistant when it comes to international pressure for more trade openness and still today has significant “trade barriers” in place. Similarly, they do not expect African countries to fully open their markets. Bodomo (2017) notices that Chomsky (1998) already pointed out that all industrialized countries have applied protectionist trade and investment policies during one or several stages of their development (Bodomo 2017, 16f.).

3.2 The impact of Rules of Origin

Considering the massive divergence in resources and the unequal strength and capacity, the principle of reciprocity does not necessarily translate into fairness. According to Kohnert (2015), similarly to the “Structural Adjustment Programmes” (SAPs) in Africa (1980s/1990s), potential gains from this kind of reciprocal elimination of trade barriers will most likely turn out to be void in light of negative terms of trade as a result of low labor productivity (Kohnert 2015, 144f.) (GRAIN 2017). Through preferential market access, it is assumed that local companies are enabled to engage in new exporting opportunities more easily. Although not untrue, lately it has become clear that non-tariff barriers, in particular rules of origin (ROOs), are sometimes more restrictive than tariffs (Wouters, Defraigne und Burnay 2015, 376). Within Free Trade Agreements, they ensure that products from third countries do not avoid paying duties by shipping through countries with preferential access. However, by specifying the amount of required local materials and processing, these rules do not reflect real global supply chains, often impede competitiveness, and prevent trade diversification (Andriamananjara, et al. 2009, 33f.) (Bjuggren and Lundström 2012, 34).

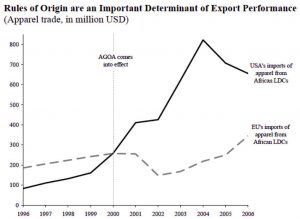

Figure 3 clearly demonstrated the importance of rules of origin determining export success. While both the EU’s “Everything but Arms” (EBA) as well as the USA’s African Growth and Opportunity Act (AGOA, introduced in 2000) grant duty and quota free access to its markets, AGOA provides ROOs that are much easier to meet than the EU’s requirements (Andriamananjara, et al. 2009, 33f.).

Source: (Andriamananjara, et al. 2009, 34)

China can offer a distinct advantage in this matter. In 2017, Beijing introduced new rules of origin for all LDCs that, among others, expand cumulation to regional economic groups (e.g. ECOWAS) and allow utilization of any goods or materials originating from or produced in China (Hu 2017). Technically this detail is not necessarily a generous offer as it is of course in China’s interest, however considering that it is often most competitive to use Chinese materials in Africa, this rule might still see a very beneficial outcome for African manufacturing and industrial companies, being able to more efficiently produce and export. Even if the EU does not want to allow Chinese materials into rules of cumulation, there is much room to promote user-friendliness by, for example, simplifying the long list of product-specific rules (Bjuggren and Lundström 2012, 34).

Conclusion

The Cotonou agreement needs to change to better reflect the EU’s priorities in Africa. The renewal in 2020 is a good opportunity for adaptations.

The EU should, of course, not neglect human and social rights or disregard their own values, yet it seems as if to some extent the Union has to take a step back from proactively demanding other countries to live by the same rules. Cultural values develop over time and can hardly be “enforced” through governmental action. It is clear, that all of this should not imply that each and every action put forward by China is preferable. On the contrary, so far, they have not communicated their intents well or justified certain issues and consequences of its measures (Bodomo 2017, 49f.).

Ultimately, everyone, whether it is the EU, China or the US, has to stop “discussing about Africa”, and instead accept that African countries will forge and lead their own strategies. African countries are noticeably engaged in reforming trade and investment agreements, especially through harmonizing regional provisions (Pan-African Investment Code, Continental Free Trade Area, etc.). These initiatives demonstrate the determination to create a more balanced investment framework for Africa, oriented towards sustainable development (UNCTAD 2017, 130). The promising framework “Agenda 2063” is committed to outline a large-scale investment and development policy that all foreign investors, whether it is the EU, China, or any other country, must get accustomed to (Bodomo 2017, 87f.).

- Alden, Chris, and Ana Cristina Alves. “History & Identity in the Construction of China’s Africa Policy.” Review of African Political Economy, 2008: 43-58.

- Andriamananjara, Soamiely, Paul Brenton, Jan Erik Uexküll, von, and Peter Walkenhorst. Assessing the Economic Impacts of an Economic Partnership Agreement on Nigeria. Policy Research Working Paper, Washington, D.C.: World Bank, 2009.

- Bjuggren, Carolina, and Hanson Elenor Lundström. “The Impact of Rules of Origin on Trade.” Kommerskollegium: The Swedish National Board of Trade, Stockholm, 2012.

- Bodomo, Dr. Adams. The Globalization of Foreign Investment in Africa: The Role of Europe, China, and India. Bingley, UK: Emerald Publishing Limited, 2017.

- Bräutigam, Deborah, and Tang Xiaoyang. “African Shenzhen: China’s special economic zones in Africa.” Journal of Modern African Studies, 2011: 27-54.

- Carmody, Pádraig. The New Scramble For Africa. Cambridge, UK: Polity Press, 2011.

- Cheru, Fantu, and Cyril Obi. “De-Coding China-Africa Relations: Partnership for development or “(neo) colonialism by invitation”?” The World Financial Review, September-October 2011: 72-75.

- Djeri-wake, Nabine. “The Impact of Chinese Investment and rade on Nigeria Economic Growth.” ATCP – African Trade Policy Center. no. 77. Economic Commission for Africa, 2009.

- Ehizuelen, Michael Mitchell Omoruyi. “More African countries on the route: the positive and negative impacts of the Belt and Road Initiative.” Transnational Corporations Review, November 21, 2017: 341-359.

- Etzold, Marc. “Sachs: ‘China’s development strategy is more successful than Europe’s’.” Edited by Euractiv. WirtschaftsWoche, June 2016.

- European Commission. “EU proposes a modernised partnership with Africa, the Caribbean and the Pacific countries.” European Commission Press Release Database, December 2017.

- European Commission. “Evaluation of the Cotonou Partnership Agreement.” Joint Staff Working Document, Brussels, 2016b.

- Fioramonti, Lorenzo, and Patrick Kimunguyi. “Public and Elite Views on Europe vs. China in Africa.” The International Spectator, 2011, 46 ed.: 69-82.

- Giesbert, Lena, Birte Pfeiffer, and Simone Schotte. “German Institute of Global and Area Studies.” GIGA Focus: Economic Partnership Agreements with the EU: Trade-Offs for Africa. December 2016. https://www.giga-hamburg.de/en/publication/economic-partnership-agreements-with-the-eu-trade-offs-for-africa (accessed February 18, 2018).

- GRAIN. “Colonialism’s new clothes: The EU’s Economic Partnership Agreements with Africa.” August 21, 2017. https://www.grain.org/article/entries/5777-colonialism-s-new-clothes-the-eu-s-economic-partnership-agreements-with-africa (accessed February 18, 2018).

- Hu, Weining. “China Briefing.” New Import Measures in China to Benefit African, Southeast Asian Exporters. April 18, 2017. http://www.china-briefing.com/news/2017/04/18/new-import-measures-in-china-to-benefit-african-southeast-asian-exporters.html (accessed March 27, 2018).

- ITUC / ETUC. “Outcomes of the Trade Union Conference on Economic Partnership Agreements – Africa/EU.” bilaterals.org. October 9-10, 2017. https://www.bilaterals.org/IMG/pdf/outcomes_of_the_trade_union_conference_on_economic_partnership_agreements__africa_eu.pdf (accessed March 18, 2018).

- Kim, Yejoo. What Africa can learn from China’s special economic zones. Edited by The Conversation. December 4, 2015. http://theconversation.com/what-africa-can-learn-from-chinas-special-economic-zones-51517 (accessed February 12, 2018).

- Kohnert, Dirk. “Horse-trading on EU–African Economic Partnership Agreements.” Review of African Political Economy, February 05, 2015, Vol. 42 ed.: 141-147.

- Koné, Salif. “Economic Partnership Agreement between West Africa and the European Union in the Context of the World Trade Organization(WTO) and the Regional Integration Process.” Journal of Economic Integration, March 2010, 25 ed.: 105-129.

- Multilateral Investment Guarantee Agency (MIGA). “Environmental and Social Review Summary: China Glass Holdings Limited.” Project Review Report Summary, World Bank Group, Washington, D.C., 2017.

- Sanders, Sir Ronald. “The EU, Economic Partnership Agreements and Africa.” The Round Table: The Commonwealth Journal of International Affairs, October 30, 2015, Vol. 104 ed.: 563-571.

- Schnauder, Andreas. derstandard.at. September 3, 2017. http://mobil.derstandard.at/2000063498203/EU-laesst-Ressourcen-ausbeuten?ref=artwh (accessed March 26, 2018).

- Stefan, Leopold. derstandard.at. November 29, 2017. https://derstandard.at/2000068665100/zwischen-Partner-und-geberEuropas-Afrika-Strategie (accessed March 26, 2018).

- UNCTAD. World Investment Report 2017. Geneva: United Nations Publication, 2017.

- World Bank. “An Overview of Six Economic Zones in Nigeria: Challenges and Opportunities.” Policy Note, Washington, D.C., 2012.

- World Trade Organization. “Azevêdo highlights important role of trade and investment in promoting sustainable development.” High-Level Forum on Facilitating Trade and Investment for Development. Abuja, Nigeria: World Trade Organization, November 2, 2017b.

- Wouters, Jan, Jean-Christophe Defraigne, and Matthieu Burnay. China, the European Union and the Developing World. Cheltenham: Edward Elgar Publishing Limited, 2015.

ISSN 2305-2635

The views expressed in this publication are those of the authors and not necessarily those of the Austrian Society of European Politics or the organisation for which the author works.

Keywords

Cotonou, ACP, EPA, conditionalities, Africa, China, China in Africa, Rules of Origin, Foreign Direct Investment, Free Trade Agreements, 2020, Trade

Citation

Baier, J. (2019). Cotonou 2020 – What the European Union can learn from Chinese trade and investment relations with Africa. Vienna. ÖGfE Policy Brief, 02’2019