Das geplante Freihandelsabkommen zwischen der EU und Kanada – kurz CETA – trifft bei einer Mehrheit der Österreicherinnen und Österreichern auf wenig Gegenliebe. Zu diesem Ergebnis kommt eine aktuelle österreichweite Umfrage der Österreichischen Gesellschaft für Europapolitik (ÖGfE).

73 Prozent der befragten ÖsterreicherInnen lehnen das Freihandelsabkommen zwischen der EU und Kanada ab, 11 Prozent stehen ihm positiv gegenüber. 16 Prozent können oder wollen zu dieser Frage nicht Stellung beziehen.

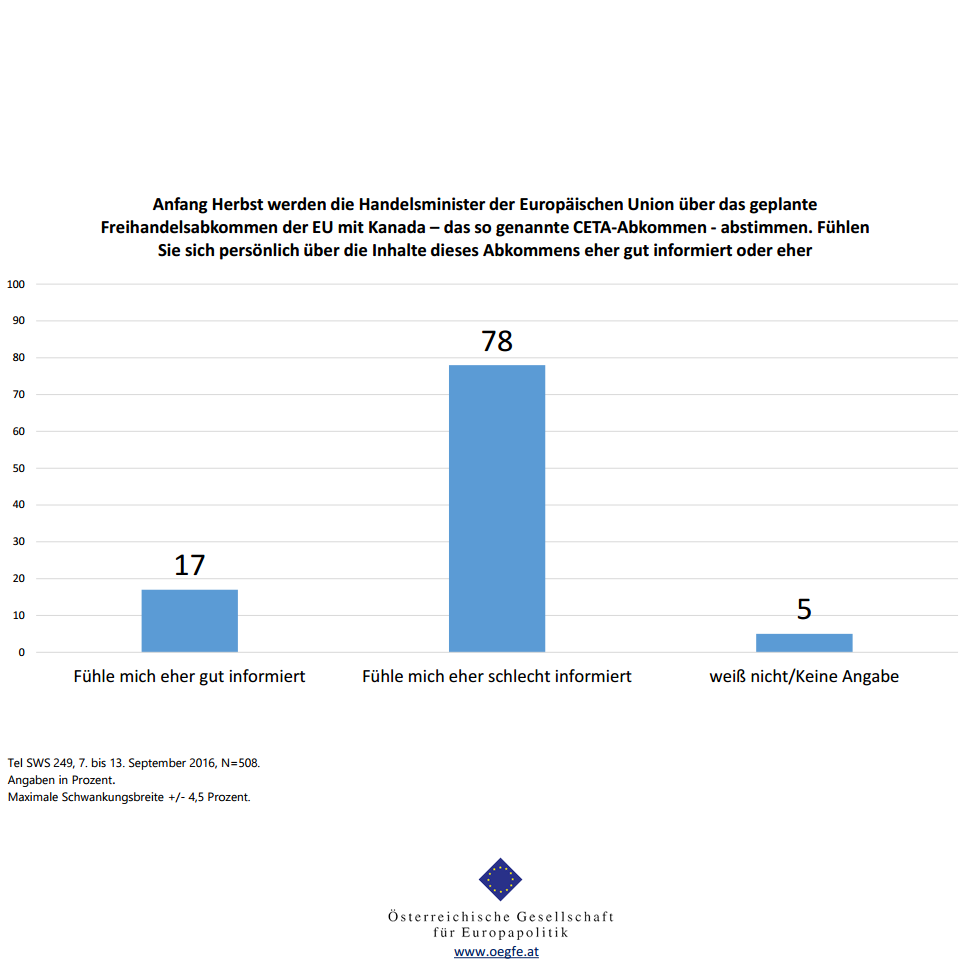

78 Prozent der Befragten fühlen sich „eher schlecht“ über die Inhalte von CETA informiert, 17 Prozent „eher gut“ (5 Prozent „weiß nicht/Keine Angabe).

Die aktuelle Diskussion über mögliche Vor- und Nachteile des Freihandelsabkommens stößt bei den ÖsterreicherInnen auf geteiltes Interesse: 51 Prozent zeigen sich daran „stark interessiert“, fast ebenso viele (45 Prozent) sind eher „weniger interessiert“ (4 Prozent „weiß nicht/Keine Angabe).

Fragt man die ÖsterreicherInnen nach ihrer generellen Einstellung zum Freihandel, so zeigt sich, dass auch hier die Skepsis überwiegt. 51 Prozent bezeichnen sich „eher als Gegner“, 31 Prozent „eher als Befürworter“. Ein hoher Prozentsatz (20 Prozent) beantwortete diese Frage mit „weiß nicht“ oder gab keine Angabe.

Die aktuelle Umfrage wurde von der Sozialwissenschaftlichen Studiengesellschaft vom 7. bis 13. September 2016 im Auftrag der ÖGfE durchgeführt. Befragt wurden österreichweit 508 Personen per Telefon (repräsentativ für die österreichische Bevölkerung ab 16 Jahre/Gewichtung nach Geschlecht, Alter und Bildung). Maximale Schwankungsbreite ca. +/- 4,5 Prozent. Differenz auf 100 Prozent aufgrund gerundeter Werte.

Weitere interessante Artikel

23. Juli 2024

Krone TV “Nachgefragt”: Wichtige Wahl für EU – Harris gegen Trump

Paul Schmidt spricht im Krone TV-Interview über die Bedeutung des US-Wahlkampfs für die EU, die Sicht der Europäischen Union auf Ungarns aktuelle Ratspräsidentschaft und die Prioritäten der wiedergewählten Ursula von der Leyen.

22. Juli 2024

Puls24 NEWS: EU-Parlament kommt erstmals seit Wahl zusammen

Paul Schmidt, Generalsekretär der österreichischen Gesellschaft für Europapolitik, spricht im Puls24 NEWS Interview über die erste Sitzung des EU-Parlaments nach der EU-Wahl im Juni. Als mögliche Themen werden die Neubesetzung zahlreicher Spitzenjobs und der Ratsvorsitz Ungarns erwartet.

11. Juli 2024

The European Union in Search of Its Own Mythology

By: Olena Pokotilo

The attractiveness of the European Union is based on its economic and social model as well as on its manifold national cultural heritage. Throughout the post-Cold War period, the EU has not actively promoted pan-European myths and struggles today with creating a cohesive and credible common narrative. In this context, the author of this Policy Brief argues that to maintain its unity amidst global instability and evolving political landscapes, the EU must develop new, meaningful myths. She discusses the characteristics of the myth-design of the Union and offers policy recommendations.

The attractiveness of the European Union is based on its economic and social model as well as on its manifold national cultural heritage. Throughout the post-Cold War period, the EU has not actively promoted pan-European myths and struggles today with creating a cohesive and credible common narrative. In this context, the author of this Policy Brief argues that to maintain its unity amidst global instability and evolving political landscapes, the EU must develop new, meaningful myths. She discusses the characteristics of the myth-design of the Union and offers policy recommendations.

Weitere interessante Artikel

23. Juli 2024

Krone TV “Nachgefragt”: Wichtige Wahl für EU – Harris gegen Trump

Paul Schmidt spricht im Krone TV-Interview über die Bedeutung des US-Wahlkampfs für die EU, die Sicht der Europäischen Union auf Ungarns aktuelle Ratspräsidentschaft und die Prioritäten der wiedergewählten Ursula von der Leyen.

22. Juli 2024

Puls24 NEWS: EU-Parlament kommt erstmals seit Wahl zusammen

Paul Schmidt, Generalsekretär der österreichischen Gesellschaft für Europapolitik, spricht im Puls24 NEWS Interview über die erste Sitzung des EU-Parlaments nach der EU-Wahl im Juni. Als mögliche Themen werden die Neubesetzung zahlreicher Spitzenjobs und der Ratsvorsitz Ungarns erwartet.

11. Juli 2024

The European Union in Search of Its Own Mythology

By: Olena Pokotilo

The attractiveness of the European Union is based on its economic and social model as well as on its manifold national cultural heritage. Throughout the post-Cold War period, the EU has not actively promoted pan-European myths and struggles today with creating a cohesive and credible common narrative. In this context, the author of this Policy Brief argues that to maintain its unity amidst global instability and evolving political landscapes, the EU must develop new, meaningful myths. She discusses the characteristics of the myth-design of the Union and offers policy recommendations.

The attractiveness of the European Union is based on its economic and social model as well as on its manifold national cultural heritage. Throughout the post-Cold War period, the EU has not actively promoted pan-European myths and struggles today with creating a cohesive and credible common narrative. In this context, the author of this Policy Brief argues that to maintain its unity amidst global instability and evolving political landscapes, the EU must develop new, meaningful myths. She discusses the characteristics of the myth-design of the Union and offers policy recommendations.