Policy Recommendations

- Engage in a strategic discussion on the current state and future of European integration with a focus on medium- and long-term challenges posed by the current global polycrisis.

- Position the EU as a medium-sized regional power and open economy based on a European economic and social model as enshrined in the EU Treaties. This also means managing the inherent tension between global political ambition and reality.

- Avoid the risk of delegating too many tasks to the EU level as well as overextension, and rather concentrate on further deepening the European single market, in particular with regard to aspects of climate and European industrial policy.

Abstract

This Policy Brief * discusses six important and interdependent elements of the global crisis facing the European Union (EU). In addition, to highlighting the background of the EU’s strategic orientation, the author develops specific perspectives for the EU’s policy orientation.

In light of its geopolitical position, the EU needs to cooperate closely with the United States (US), especially with regard to security issues. The EU is not yet represented in a number of politically and economically important institutions, its global outreach is limited. It should therefore be considered a wealthy but medium-sized regional power.

Future economic and monetary developments are likely to increase the global role of the US relative to that of the EU. Of special relevance is the need for Germany, the EU’s biggest economy, to adjust its business model, which has long been based on strong exports and cheap energy imports.

To counter the risk of a looming deep crisis in the EU, the author proposes a strategy of pragmatic dynamism. This means avoiding the above-mentioned dangers of overextension, while at the same time strengthening the role of the EU single market and of the European Monetary Union. Of special importance in this context are (i) pragmatic European climate and energy policies, (ii) a common European industrial policy and (iii) an efficient system of European public finances.

All in all, this Policy Brief illustrates the need for a comprehensive view of the various interacting elements of the global polycrisis and the challenges and chances the EU is facing.

* The views expressed in this publication reflect only those of the author.

****************************

The looming deep crisis in Europe – and what to do about it

With regard to the EU’s strategic agenda, we need a better understanding of the medium- and long-term developments ahead. A short overview of the present global crisis will be followed by a more detailed discussion of specific long-term trends.

1) Global background

There are (at least) six important and interdependent trends of the present global crisis which overlap.

(a) Geopolitical tensions

The Russian invasion of Ukraine has been the first large-scale war in Europe in many years which takes place in what historian Timothy Snyder (2010) called “the Bloodlands”, a region where Nazi Germany and Stalin’s Soviet Union committed horrible mass murders during World War II. There is as yet no clear perspective of how this war will end, but it is obvious that support from the West will be essential for the survival of Ukraine as an independent state. Without a clear outcome on the battlefield, the war may turn into a frozen conflict, similar to the situation in Korea, which was the first military conflict of the Cold War.

Of great global relevance are the growing tensions between the People’s Republic of China and the United States (US). A new geopolitical structure is emerging, with the West under the clear leadership of the US and the autocratic East with Russia (for the time being) as the most aggressive proponent but China as the dominant player and a sizeable number of developing nations, with a broad range of political and economic perspectives but united by their scepticism of US dominance.

(b) Energy policy

The geopolitical tensions have brought about dramatic changes in the world energy markets, leading to much higher and more volatile energy prices, particularly in Europe. For the US as a net exporter of energy, these tensions have increased her strategic strength, while they have aligned the common interest of traditional oil-exporting countries and Russia (see Organization of the Petroleum Exporting Countries/OPEC Plus, the plus being Russia). In contrast, Europe and many developing countries are net importers of energy. This dependence may decline over time if energy saving and energy autonomy policies become more effective – but for the time being, it is Europe’s most important geopolitical and economic handicap.

(c) Inflation and monetary policy

In light of the sharp rise in inflation, most major central banks have tightened monetary policy. The US Federal Reserve’s restrictive monetary policy may lead to economic problems in developing countries with high external debt in US dollar. This, in turn, may lead to political tensions, which may ultimately increase China’s influence in this part of the world.

In industrialised countries, the effects of restrictive monetary policy work faster on reducing real economic output (with a lag of about 1 to 2 years) than on reducing inflation (with a lag of 3 to 4 years), which leads to a short- and medium-term tendency of stagflation. For the longer term perspective, inflation rates are expected to be lower than they are at present but still higher than in the pre-COVID-19 period. The era of very low interest rates is definitely over – there is no returning to the happy days of the Great Moderation[1], which were characterised by low global inflation and strong economic growth.

(d) Globalisation

Even without a war-induced breakdown of economic globalisation, the intensity of globalisation may be expected to decelerate: This slowdown will be a direct effect of geopolitical tensions but it may also be ascribed to a change in economic sentiment in post-COVID-19 times, as countries now give a higher priority to resilience considerations. Globalisation was the most important reason for the low-inflation period after 2010. Now that its role is declining, inflation rates will be higher than in the past, especially in very open economies, and increases in productivity will be lower, due to a weakening of the international division of labour.

(e) Climate change

It has become obvious that most countries will not achieve the ambitious goals set in a series of world climate summits. In advanced high-income countries mitigating climate change will require substantial structural reforms in practically all fields of life but especially with regard to energy policy and financing structures.

On a global level, the slow progress in fighting climate change has already increased tensions between the West and developing countries, which are more directly and dramatically affected by climate change. Even if we fail to reach an effective general loss and damage agreement, we will need to increase the financing of technical measures to accommodate, at least to a certain extent, the negative effects of climate change. In addition, these effects may lead to new waves of migration, which are associated with economic and political costs.

(f) Demography

In a long-term perspective, the world is facing massive demographic change. Asia’s share in the world population will increase further (with India becoming the most populated country on earth). Africa, too, will experience dramatic population growth. This will have direct economic and political effects. Already in 2023, India will become the fifth largest economy in the world (after the US, China, Japan and Germany). It will overtake the United Kingdom (UK) and, very likely, soon also Germany.

On the other hand, there are still substantial differences in per capita income and thus the (economic) standard of living. In 2021, India’s average per capita income (Purchasing Power Parity/PPP basis) was at about USD 7,300, while that of Germany and Austria was at around USD 60,000. It is to be hoped that a strong catching-up process will take place in the developing world. Reducing the existing gap in the standard of living will obviously take a long time, however. This catching-up process will pose challenges with regard to environment and climate policies. In the meantime, migratory pressure toward Western countries is likely to remain very strong – with the corresponding economic and political effects.

2) Dealing with worldwide challenges – the EU perspective

The EU does not yet equal all countries of Europe. While some countries took the decision to not join or even leave the EU, such as Norway or the UK, a large number of other non-member countries wish to gain membership. For this latter group, much depends on the development of the EU’s present structure – especially if the EU faces a deep crisis. With regard to the challenges discussed above, the EU has been hit hardest among industrialised countries. The negative impact is especially strong when compared with the US, who might emerge as the political and economic winner of this crisis.

At the beginning of her term, President of the European Commission, Ursula von der Leyen promised that the new Commission would become a geopolitical one. This vision has become reality – but unfortunately not in the way she had in mind. The main challenge for the EU now is the Russian attack on Ukraine with all its dramatic side effects. The EU reacted fast, in a united front and in close collaboration with the US (which required perhaps some nudging). All in all, concerning the war of Russia against Ukraine the EU demonstrated that under pressure it is capable to take strong and coordinated action.

The main challenge for the EU now is the Russian attack on Ukraine with all its dramatic side effects.

Still, the process of reaching these decisions has revealed substantial differences between the EU member states, based on different historical experiences, geographic location and economic dependencies. The Baltic States and most Eastern European EU members have been the strongest supporters of a tough stand against Russia. For Germany, the aggressive policy of President Vladimir Putin after a long period of “normal isolation”, strongly influenced by its own problematic history, thus the strict policy against Russia and Belarus has meant an abrupt change of a long-established – and at least economical successful – mutual cooperation. A symbol of this cooperation are the two direct gas pipelines from Russia to Germany. The reluctant closing of the fully built Nord Stream 2 pipeline has been a heavy blow for Germany’s energy strategy, as this pipeline was set to transport relatively cheap gas, which would be needed as a substitute after the (probably premature) decision to close all domestic nuclear and coal plants. In the long-term, however, the abrupt end of the old energy strategy will force and thus help Germany to engage in a safer mix of energy supply – both with regard to political and environmental perspectives.

Apart from humanitarian, financial and military assistance, the main (US-lead) measure against Russia has been a complex network of financial and trade sanctions. In light of some EU member countries’ high energy dependency, these sanctions have been only partial, so substantial financial flows to Russia still continue. All in all, the EU has been successful in reducing its energy dependency on Russia. But this shift has been accomplished because the EU has given priority to (legitimate) geopolitical over economic considerations, and has perhaps accepted new dependencies. In the medium term, this trade-off may give rise to new conflicts among member states and it will have to be seen in the general context of the EU’s climate policy.

All in all, the EU has been successful in reducing its energy dependency on Russia.

Concerning the EU’s future perspectives, increased attention is now given (again) to the issue of a stronger political and military international role. According to Josep Borell, High Representative for Foreign Affairs and Security, the EU has to learn “the language of power”.[2] Here, however, the limitations are obvious: Foreign and military affairs are still the responsibility of the individual members, with the EU still playing a weak coordinating role. This is reflected, for instance, by the fact that the EU still has no seat in the United Nations Security Council, and the European Central Bank (ECB) has no seat on the International Monetary Fund (IMF) and World Bank boards. Transferring military and foreign policy responsibilities from the member states to the EU level was already very difficult when the Union was still small and to a certain degree more homogeneous – it has practically no chance of realisation in the EU of today.

In this context, offering the prospect of EU accession to Ukraine so quickly in a symbolic gesture is understandable but seems also highly problematic (this is even more true for countries that have historically and economically much weaker ties to Europe such as Georgia). If the Ukraine is looking for stronger security arrangements, this is clearly a case for NATO (North Atlantic Treaty Organization). Ukraine will obviously need substantial funding for the reconstruction after the war. This calls for a Marshall Plan like programme funded by the EU and the US and intensifying the economic relations between Ukraine and the EU is, of course, in our common interest.

If the Ukraine is looking for stronger security arrangements, this is clearly a case for NATO.

However, EU membership is a totally different issue. It allows countries to participate in the EU’s decision-making processes, where members at present still have a right of veto in many instances. It also means taking part in very costly EU policies, especially in agriculture and regional development. Ukraine is a very big and as of today very poor country (with a population of 43.8 million and a gross domestic product/GDP per capita of EUR 3,800, compared with an EU average of EUR 33,400). EU membership for Ukraine would lead to a massive change of the EU’s political structure, and it would imply an enormous need for future funds. This would necessitate a massive increase in budget contributions from the richer EU members, and it would perhaps also lead to lower EU funding for those EU countries that are at present net recipients. As will be shown later, all EU countries will be forced to follow stricter fiscal policies in the near future. So reaching an agreement on additional EU financing needs would be bound to become extremely difficult and controversial.

EU membership for Ukraine would lead to a massive change of the EU’s political structure, and it would imply an enormous need for future funds.

Of course, accession negotiations would take a long time, as evidenced by the talks with the countries of the Western Balkans or the surrealistic constellation with Turkey. Nevertheless, seriously starting accession negotiations as long as the EU is constitutionally and financially unable to integrate new members would be in bad faith. It might lead to a constellation where candidate countries are exposed to long and frustrating periods of well-meaning but at times also to paternalistic, EU interventions and fundamental uncertainty. Therefore, realistic and faster available alternatives are necessary. Such an alternative may be French President Emmanuel Macron’s proposal of a new European Political Community that makes a lot of sense (even though it has been widely criticised). At the end of the day, making proposals based on illusions and ignoring potential future conflicts may be one of the main roots of a looming deep crisis in Europe. Of course, it is necessary to have a “European vision”. But we should avoid a constellation of too much vision and too little realism.

Relative to other regions of the world, Europe is a very open economy and thus specifically affected by the slowing pace (or even shrinking role) of globalisation. This is especially true for Germany, EU’s most important economy. The German business model, which has been highly successful up until now, is an export-driven economy based on high technological effectiveness, but also on cheap energy imports. Germany has had the highest current account surplus worldwide in absolute numbers for many years. Maintaining this business model in its present form will become more difficult in the future both for political reasons and with regard to climate policy. Indeed, we are already seeing indications of an ongoing de-industrialisation in Germany, whereas the US – thanks to low energy costs and protectionist measures – has launched a resolute policy of re-industrialisation.

A weakening of Germany’s economic dynamics may have massive negative political and economic effects on the further development of the EU. Germany is by far the biggest net contributor to the EU budget. If budget problems in Germany increase, it may be very difficult for the German government to convince the public that it is in their best interest to finance additional EU expenditures – even though the country is the main beneficiary of the European single market on general economic terms.

A weakening of Germany’s economic dynamics may have massive negative political and economic effects on the further development of the EU.

With regard to the changing of a monetary policy era, Europe is more exposed to the effects of this transformation than other parts of the world, especially the US. The end of expansionary monetary policy and particularly the reduction of the volume of government bonds held by central banks (“quantitative tightening”) will make debt financing costlier and more difficult for governments. This may hold even for a “safe haven” like the US, where debt is in her own currency. It is much more relevant for the member countries of the European Monetary Union (EMU), where the euro is technically like a foreign currency, as it is not under the management of a national central bank. At least in theory, each member country thus might default on its sovereign debt. Being aware of this risk and to prevent moral hazard behaviour, the founding fathers of the EMU agreed on the Stability and Growth Pact as an instrument to enforce fiscal discipline. Even more important from the outset was the prohibition of central bank financing of government debt (“monetary financing”) to ensure the control of capital markets over fiscal policy. In a much-discussed wording, former German chancellor Angela Merkel described the need for a “market-conforming democracy”.[3]

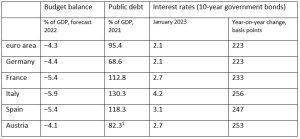

There are great differences in the fiscal positions of EMU member countries (see table 1). Due to the ECB’s bond buying programmes up until now, these differences may not have been fully reflected in market interest rates. The ECB is – rightly – concerned that a widening of the differences between national interest rates (spreads) may lead to financial instability. When starting its new restrictive course of monetary policy, the ECB therefore also introduced the Transmission Protection Instrument (TPI) as a precautionary measure to avoid “economically not justified” differences in interest rates across the members of the euro area. But the TPI as well as the instruments of the European Stability Mechanism will become operative only with certain conditionality. This may create massive internal political problems in the countries that are potentially affected such as Italy.

The ECB is – rightly – concerned that a widening of the differences between national interest rates (spreads) may lead to financial instability.

Table 1: Budget balance, public debt, interest rates

Source: Eurostat, Economist Intelligence Unit.

1 2022: 77.1%

In a general perspective, maintaining fiscal discipline will become very difficult for the EU (and especially the euro area) members. Massive additional expenditures will be needed in the context of an aging society and the green transition but also for military purposes and funding of EU programmes. It will not be easy to choose expenditure items to cut in order to balance the budgets and additional taxes or higher social security contributions will become necessary. This may lead to difficult political discussions in the EU member states on the distributional aspects of their public finances. In some countries, political conflict may lead to political instability, which, in turn, may create new problems for collective decision-making at EU level.

Concerning climate policy, the EU takes pride in being a pioneer at the international level. The European Climate Law now enshrines the 2050 climate neutrality goal, the “Fit for 55” package is an ambitious set of initiatives to realise the 2030 climate objectives. However, it is likely that many member states and the EU as a whole will be unable to adequately meet the ambitious climate goals. On the other hand, the EU is the only institution worldwide with legal provisions that impose substantial penalty payments in case of noncompliance. This, too, may be expected to lead to serious political conflicts in the near future.

Another aspect is even more important, though: the potential negative effects of European climate policy on international competitiveness. The danger of de-industrialisation in Europe is already imminent, especially in light of much higher energy costs in Europe than elsewhere but also with regard to other climate-related policy decisions. The latter may cause carbon leakage (a shift of carbon emissions to regions with less stringent climate legislation). Industry moving to other parts of the world would take a toll on Europe but at the same time may have net negative effects on the global climate. The European Commission is aware of this problem and has proposed a Carbon Border Adjustment Mechanism (CBAM). However, this mechanism would restore competitiveness only with regard to imports, not with regard to exports. And in any case, introducing CBAM will not be easy against massive opposition from countries like the US and China, who responded with threats of a trade war.

The danger of de-industrialisation in Europe is already imminent, especially in light of much higher energy costs in Europe than elsewhere but also with regard to other climate-related policy decisions.

Basically, a climate policy that focuses on ambitious goals but does not adequately factor in the associated technical, social and economic implications may face severe problems with general political and social acceptance by the European public.

Concerning international trade relations, the focus has shifted to technology and “strategic autonomy”. The EU in these fields finds itself in strong competition with the US and also with China. Already in 2020, the US “CHIPS and Science Acts” (CHIPS standing for Creating Helpful Incentives to Produce Semiconductors) involved a total volume of USD 280 billion. The EU’s answer – a “European Chips Act” – provides for expenditures of EUR 43 billion.

An imminent danger of a trade war emerged from the US government’s “Inflation Reduction Act” (IRA), the US flagship plan to green its domestic economy. This is basically a positive move, but the hard core of IRA are incentives for the (re-) location of industry to the US. In combination with the much lower energy prices in the US, IRA increases the danger of a substantial shrinking of the EU’s industrial base. This has led to calls for adequate policy responses.

In spring 2023, the European Commission presented a “Green Industrial Plan”[4], but given the strong export-orientation of the EU economy the Commission wisely does not advocate to engage in a tit-for-tat strategy against the US.[5] Rather it recommends a faster use of the hundreds of billions of euro, still in the EU Recovery and Resilience Facility, a more flexible approach with regard to state aid for industrial research and development activities, a “European Sovereignty Fund” to support innovation and strategic industrial projects and further international trade agreements.

All these proposals are important examples of a strategy of “EU deepening” to strengthen the European economy. Moreover, given the already now existing substantial differences in economic and fiscal strength among EU member countries a EU-wide approach would mean a reconciliation of climate neutrality policy with industrial competitiveness policy at the European level. “Stronger” EU member countries like Germany, Netherlands and also Austria, however, up to now prefer to use their fiscal fire power for national initiatives.[6] Already now, the (temporary) relaxations of subsidy restraints has been dramatically unbalanced. Of the EUR 672 billion subsidies approved under the EU’s temporary crisis framework, 53 percent has been notified by Germany, equating to 9 percent of its annual GDP, 24 percent (about 6 percent of national GDP) by France, whereas Italy, for instance, sought approval of only 7 percent, amounting to 3 percent of national GDP.[7]

So, there exists a substantial risk that the combination of climate policy and industrial competitiveness may lead to a deeper fragmentation between EU countries. Difficult negotiations will be necessary to get to a strong and coordinated answer to these challenges. In the well-researched lengthy article in the Financial Times, quoted above, the authors even see “the very fundamentals of the bloc`s economic model” at stake.

So, there exists a substantial risk that the combination of climate policy and industrial competitiveness may lead to a deeper fragmentation between EU countries.

3) Overcoming challenges

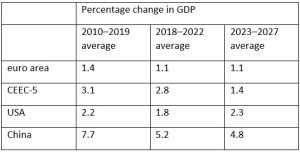

As discussed in the chapter above, the polycrisis emerging worldwide could trigger especially negative effects on the member countries of the euro area and the EU (see table 2). The medium-term growth differential to the US will widen. Whereas economic growth is expected to pick up in the US, this is not the case for the euro area. Even though the EU’s Eastern European member countries will still post higher growth than the euro area, it will be substantially lower than in the past. This means that closing the gap in per capita incomes will take longer than expected.

Without strong policy responses, the anticipated weak economic performance may, in combination with the other geopolitical challenges discussed, indeed lead to a deep and long-lasting crisis in Europe. Effective policy responses to worldwide challenges will in all likelihood not come from the individual (and in global comparison all small) European nation states but will have to come from a strong EU. This, however, requires a realistic assessment of both the present situation and the future perspectives of the EU.

Table 2: Comparing economic dynamics

Source: Austrian Institute of Economic Research Vienna (2022). CEEC-5 stands for the Czech Republic, Hungary, Poland, Slovakia and Slovenia.

Taking a global view, the EU has to be seen as a medium-sized and wealthy regional power. Based on historical, cultural and economic ties, the EU (and also all of Europe) has the closest relationship with the US among the global players. Moreover, even if Europe succeeds in strengthening its military capacity, it will need US assistance for full military security in the foreseeable future.

On the other hand, though, the fundamental raison d’être of European integration (in addition to securing internal peace) is upholding and strengthening a specifically European social and cultural model, which in many respects differs from the American way of life. Of course, there are numerous and important differences between the EU member states, too, but there is also a common European model enshrined in the Treaties of the European Union. One distinctive element of this model is our shared commitment to a socio-ecological market economy as opposed to the pure market social models of the US. Keeping this European model strong and alive, even amid the difficult global environment to be expected in the future, is the biggest challenge ahead for the EU. In addition, to a successful economic performance, an important element of this European model is its emphasis on social aspects, such as health services, education, housing, environment, pension systems and other elements that allow people to live a good, physically safe life with adequate social protection. This goes hand in hand with a strong democratic system and greater opportunities for economic codetermination at the micro- and the macro-level and, in most cases, with better public services and a higher local security level.

The European social model has been a cornerstone of the project of European integration from the beginning. Of course, this model was never realised to the same extend in all EU member countries, but to a certain degree it has been achieved in the core EU countries. Indeed, this (or the vision underlying it) is why a clear majority of the population in all EU member states supports EU membership. To keep this support, the politics of European integration have to follow these priorities.

With regard to the visions and challenges discussed above, it is imperative to take into account both the opportunities the EU offers and its limitations as a comparatively new, medium-sized political entity. In fact, we have a number of opportunities on how to respond proactively to current and upcoming challenges, but such responses have to be based on realistic assumptions. This means above all avoiding the danger of overextension, a risk that historically has led to negative outcomes in a number of cases, sometimes even to the breakup.

In fact, we have a number of opportunities on how to respond proactively to current and upcoming challenges, but such responses have to be based on realistic assumptions.

Jean-Claude Juncker compared the EU with a bicycle that has to be in motion to remain stable. But a cyclist who is permanently in motion or is riding too fast could ultimately also die of exhaustion. To stay with this metaphor, not only it is important to cycle, but you also have to know where you are going to. In political terms, this means that the EU needs a constitution that gives clear guidance on the division of tasks within the Union and on accession and membership requirements. The existing EU Treaties simply do not fulfil the criteria for such a constitution. This refers, for instance, to voting procedures, where still in important cases unanimity is needed, but it is also of relevance for important policy fields, such as competition policy or the politically sensitive and very costly Common Agricultural Policy (CAP). Reaching a broad public consensus is also a prerequisite for a European constitution, but this will only become more difficult as diversity increases within the EU. To avoid collapse through exhaustion, the EU has to follow a strategy of constructive realism and prevent the danger of overextension.

In political terms, this means that the EU needs a constitution that gives clear guidance on the division of tasks within the Union and on accession and membership requirements.

For the EU, this is a two-way risk. The first is with regard to the responsibilities the EU takes on its political agenda. For emerging political entities that aim for closer integration of its members (such as the US in the first century of her existence), it makes sense to concentrate on internal matters and to restrict the role as a global player to issues that are directly connected to the internal agenda, such as trade and tax issues. For instance, human rights should be a high priority within the EU and the individual countries as members of the United Nations – but trying to assume a global role in this respect would certainly risk overextending the EU’s capacities. Even the US has experienced problems with a policy based (at least officially) on global human rights – and the results have sometimes been counterintuitive (e.g. in Asia).

The second risk refers to EU membership. It has become obvious that a parallel strategy of “deepening and widening” is just not realistic. The more economically, socially, historically and geographically diverse, the more difficult it is to realise internal reforms. Even now, certain basic elements of a common European approach, such as the EMU or the Schengen Agreement, are not yet effective in all EU member states. Achieving full European integration in these fields should be a top priority.

It has become obvious that a parallel strategy of “deepening and widening” is just not realistic.

This leads to one of the most challenging open questions concerning the future of the EU: What are the limits of EU membership, how many more countries may join the EU? Many political, strategic, economic and also philosophical considerations are of relevance in this discussion. But of immediate practical importance are the questions of economic and social overextension and the need for fundamental changes to the legal structure to keep an EU of 27 members or an enlarged Union workable.[8]

Every enlargement may have very substantial political, economic and social consequences. This is why such a step requires the unanimous support of the present EU member states and of a clear majority of the population so as to avoid erosion of popular trust in the EU and its future. This leads to the basic problem, how the “European population” may express its will in matters of central importance. The traditional way of representative democracy via the European Parliament unfortunately has obvious limitations of public acceptance. For instance, in a number of EU member countries major treaty changes call for public referenda and/or at least also a vote in the national parliaments. The case of the Brexit has shown how referenda may be influenced by special interest groups and their associated press and may be mixed up with emotional national issues not at all connected with the topic of the referendum. But as has been the case with the Austrian referendum about joining the EU, a referendum may also allow for a serious and encompassing political debate and may provide unquestionable legitimacy for far reaching political decisions. Enlargement definitely is such a kind of decision.[9]

4) Conclusions

The EU needs to be able to counter the current challenges in order to avoid a looming deep crisis in Europe. To this end, it should adopt a strategy of pragmatic dynamism. What does that mean in practice?

- Fostering internal and external strength to avoid the emergence of a multi-tier structure within the EU. This means prioritising progress in fields where the goal of full integration has not yet been achieved. The most visible issue in this context is a fully functioning Schengen area for all member countries. The second issue is related to the expansion of the EMU to all EU member states. Especially in the field of monetary policy – and thus price stability – there are substantial differences between the individual countries in terms of their economic weight and political traditions. To make it acceptable to countries with a strong tradition of strict price stability, we may have to change the present voting system (one person, one vote) in the Governing Council of the ECB. This could be achieved by extending the issues for which voting power is based on capital share, as is the case at the IMF, or by forming constituencies within the Governing Council, as is the case at the European Investment Bank. The latter solution would be similar to the voting procedure at the US Federal Reserve. Such a constituency approach would give permanent voting rights to the big member countries and rotating voting rights to the smaller ones. This could also be a viable approach to creating a single EU constituency at the IMF and thus achieving appropriate representation at the global level.

- Maintaining the existing number of EU member countries, while at the same time developing broad and consistent programmes of close cooperation with neighbouring countries. This would not be on the same level as pre-accession arrangements but would be in line politically with the initiative proposed by President Macron. The programmes could include measures to enable easier access to the European single market, access to EU mobility programmes (e.g. Erasmus+), European science programmes, climate activities and other special programmes. They would, however, not mean direct political participation as well as no full access to EU agricultural and regional policies.

- As a general economic and political strategy for the existing EU member countries, concentrating on the evolution of the European single market in response to the higher risks for European foreign trade due to a reduced role and/or structural changes with regard to the dynamics of globalisation. For the EU the single market and the “freedoms” coming with it, is “the jewel in our crown”.[10] As has been shown in this Policy Brief, the European single market is already today subject to huge political, economic and climate challenges. Giving priority to its evolution thus means in practical terms to give priority to EU deepening, instead of a policy of EU enlarging.

- Developing a strategic European industrial policy to promote strategically important industry sectors, such as renewables, automotive and battery- and energy-intensive industries that need to be restructured. As discussed in this Policy Brief this is of special immediate importance, given the aggressive approach of the US in the context of the Inflation Reduction Act, which includes USD 369 billion of subsidies for green technologies and aims at attracting investment to the US. The existing NextGenerationEU and Repower EU programmes, together with new initiatives, may be seen as the seeds of a comprehensive EU industrial policy. In the strategic field of airplane production the EU has at long last been successful in creating a strong industrial enterprise, thus avoiding US hegemony in this field. The geopolitical challenges discussed in this Policy Brief also show an urgent need for the coordinated development of an efficient European weapons industry.

- Participating in worldwide action to tackle climate change but also developing specifically European programmes to reduce energy dependency and distorting differences in energy prices both at an international level and within the EU. This is an area which illustrates the need (but also the difficulty) of taking action at the European level in a constellation where conditions differ substantially between the current EU member states. The chances of reaching global climate goals are unfortunately rather small, as they depend on the effects of global policy. This is why greater weight should be given to coordinated measures to adjust to climate change, for instance, in the context of EU agrarian policies.

- Establishing an efficient European system of public finances by taking two main steps: First, we need to increase the role of common European bonds (“Eurobonds”) as a way to avoid tensions on European capital markets and to strengthen the role of the EU and its members vis-à-vis international capital markets. This is another strong argument for raising additional funds at EU level, such as revenues from environmental taxes and emission certificates, because own funds are needed as the revenue basis for repaying expiring EU bonds. Second, we need to mobilise additional public revenues at the national level in a socially acceptable way. This makes it necessary to coordinate taxation on (private and corporate) income, wealth and inheritances at EU level and introduce common EU policies against unfair tax competition both within the EU and from countries outside the EU.

To make a long story short: Yes, a deep crisis is looming in Europe. And yes, with joint efforts these challenges can be overcome.

[1] The Great Moderation is the name given to the period of decreased macroeconomic volatility and low rated inflation starting in the 1980s. For more information see: https://www.investopedia.com/terms/g/great-moderation.asp, see also Wolf, M. (2014, p. 2).

[2] For a clear-cut discussion see, for instance, Schweisgut, H. D. (2021).

[3] See the discussion on this coined expression in Wikipedia and Nowotny, E., Zagler, M. (2022, p. 153).

[4] https://ec.europa.eu/commission/presscorner/detail/en/ip_23_510.

[5] Dombrovskis, V., Timmermans, F., Vestager, M. (2023, 27 January), Financial Times.

[6] See, for instance, German chancellor Olaf Scholz, announcing a “Doppel-Wumms” initiative.

[7] Fleming, S., Hancock, A., Espinoza, J. (2023, 2 February), Financial Times.

[8] German chancellor Olaf Scholz (2022) while supporting EU enlargement made specific proposals about necessary treaty changes. These include majority voting instead of unanimity in EU decision-making as well as proposals for far reaching reforms concerning the workings of the European Parliament and the European Commission. Scholz considers these reforms as necessary to avoid – in his words – “Kafkaesk” constellations in an enlarged Europe (the speech was held in Prague!). Compare also Bernhuber, A. (2022).

[9] For a profound discussion of the “populist temptation” in Europe see Eichengreen, B. (2018, esp. p. 163). For a literary thoughtful and charming presentation of the difficult relationship between well-meaning and highly qualified political and administrative “elites” and the “European population” I recommend to read the very successful “European novels” of Austrian author Robert Menasse (2017, 2022).

[10] Dombrovskis, V., Timmermans, F., Vestager, M. (2023, 27 January), Financial Times.

Austrian Institute of Economic Research (Österreichisches Institut für Wirtschaftsforschung), Mittelfristige Prognose, WIFO Monatsberichte 10/2022, 643 pages.

Bernhuber, A. (2022), Europa braucht echte Reformen und einen neuen EU Vertrag, in Österreichische Gesellschaft für Europapolitik (ed.), Unter 30! Junge Visionen für Europa, Vienna.

Dombrovskis, V., Timmermans, F., Vestager, M. (2023, 26 January), Europe cannot afford to engage in tit-for-tat with the US, Financial Times.

Eichengreen, B. (2018), The populist temptation, Oxford.

Fleming, S., Hancock, A., Espinoza, J. (2023, 2 February). Can the EU keep up with the US on green subsidies? Financial Times.

Mandl, C. (2023), 30 Jahre Europäischer Binnenmarkt…und noch immer unvollendet, ÖGfE Policy Brief, Wien, 01‘2023, https://www.oegfe.at/policy-briefs/30-jahre-europaeischer-binnenmarktund-noch-immer-unvollendet/.

Menasse, R. (2017), Die Hauptstadt, Berlin.

Menasse, R. (2022), Die Erweiterung, Berlin.

Nowotny, E., Zagler, M. (2022), Der öffentliche Sektor (6th ed.), Wiesbaden.

Scholz, O., Rede an der Karls-Universität in Prag am 29. August 2022.

Schweisgut, H. D. (2021), Lernt Europa die Sprache der Macht? Die EU als globaler Akteur zwischen den USA und China, in Österreichische Gesellschaft für Europapolitik (ed.), 30 Ideen für Europa, Vienna.

Snyder, T. (2010), Bloodlands – Europe between Hitler and Stalin, New York.

Wolf, M. (2014), The Shifts and the Shocks, Penguin Books, London.

About the article

ISSN 2305-2635

The views expressed in this publication are those of the author and not necessarily those of the Austrian Society of European Politics or the organisation for which the author is working.

Keywords

EU, crisis, geopolitical tensions, war, inflation, monetary policy, energy, climate, enlargement

Citation

Nowotny, E. (2023). The looming deep crisis in Europe – and what to do about it. Vienna. ÖGfE Policy Brief, 02’2023